Banking

SANITIZING. THE AUGEAN STABLES IN THE BANKING INDUSTRY ( NIGERIA)

✅ The management revolution (Womenisation of Top banking executives.) to check the previous shenanigans.

✅ The females CEOs should bring to fore the need to adopt corporate governance, probity, accountability, transparency, integrity and stringent risk management practices in the conduct of the banking operations and supervision.

BANKING INDUSTRY

With the current hyperinflation (2023/24.)

The Ladies are taken over the banking Sector in Nigeria as MD/CEO:eg

1. GT Bank: Miriam Olusanya

2. Union Bank:r Yetunde Bolanle Oni

3. Access Holdings Plc: Bolaji Agbede

4. Fidelity Bank: Nneka Onyeali-Ikpe

5. Zenith Bank: Adaora Umeoji

6. Citi Bank: Ireti Samuel-Ogbu

7. SunTrust Bank: Halima Buba

8. FCMB: Yemisi Edun

9. FSDH Merchant Bank: Bukola Smith

10. Lotus Bank: Kafilat Araoye

11. Unity Bank: Oluwatomi Ayodele Somefun

BANKING ETHOS

I will implore the ladies at the top to bring to the fore need to adopt Corporate governance, Probity, accountability, transparency, integrity, and stringent risk management practices in the conduct of banking operations and supervision.

It is important to put in place Legal, Regulatory and Administrative framework as this would bring sustainable growth process in the economy, particularly financial system.

Banking over reliance on wholesale founding the benign financial setting have made them to be more complacent on their liquidity risk management systems making them under insured against adverse liquidity event.

Business models and strategies adopted by most of these banks were based on vague assumptions not foreseeing uncertainties and volatility in business environment. These are compounded by deficiencies on the part of their respective boards in their oversight functions. The boards functions – statutory responsibility and guiding corporate strategy systems for risk management. Most of the board members even lack the knowledge of how bank BUSINESSES are run with little understanding of risk business inherent in their operations In most cases some banks ensure that risk management information was either not available to the board.

Having a robust risk management framework that takes into cognizance all risk elements is of paramount importance to the long term survival of the institution. There is need for continual re- evaluation of the enterprise risk management framework no matter the level of sophistication achieved in the product or services . Very important are the followings:

— Improved Corporate governnace practices.

— Internal auditors in all organizations stand to play critical roles in promoting better corporate governance and risk management culture by providing assurance services.

At Wufasagronet, we are competent and reliable. Food technologists into Human Capital and Value Chain Development. Detailing ethics towards Global competitiveness and International best practices. At various times Wufas was:

– Factory Mgr. NIYAMCO. Bacita (Ethanol distillatio.).

– Brewmaster North Brewery Ltd Kano.

– Production Mgr. 7up bottling Co Lagos

– Tech Sales Mgr Cadbury plc Lagos.

– Plant Mgr Prime Distillery Sango Ota Ogun state.

– Ceo. Wufas on Foods.

– Currently. (PARTNER) NYSC SAED – (skills aquisation entrepreneural development.).

– Consultancy Services in Human Capital and Value Chain Development.

– email : wufasagronet@gmail.com

Banking

CHALLENGES OF BANKS CONSOLIDATION.

BANKING

Consolidation may not be literally over until all the Information and Communication Technology (ICT) infrastructure of the merged or acquired banks are fully integrated into a unified whole.

…. @WufasAgronet, we are Food Security (processing .) Advocates.

✅Earned FAO, WFP (.WA ), ROOKEFEELER FOUNDATIONS, WORLD BANK, IFAD, IDA(.action campaign ), BBC NEWS, Jagaban Army, Punch Newspapers, Today Reporters, Ripples News etc.

✅ NAAJ, PAAJ, IFAJ AND AFAN.

✅Consultancy Services in Human Capital and Value Chain Development Consultancy in Food Processing technology.

CENTRAL BANK .

The need for a vibrant banking system is the heartbeat of any economy this has being emphasized by the Central Bank. The industry has been in the throes of restructuring in order to meet the.( 4trn Naira ) minimum capital base. Recognizing the difficulties that may face most banks in meeting the minimum capital base, the CB actively supported consolidation through mergers and acquisitions.

This will result in emergence of reduced big banks after the conclusion of the exercise.

CONSOLIDATION

Consolidation will bring about changes to the banking industry. Such as :

– – The assets of rival banks come together under the control of a single institution,

– New products and services shall be developed.

– The competitive structure of the market will change

– Blue economy will create uncontested market space and make the competition irrelevant.

INDUSTRIALIZATION – PRODUCTIVITY

To support the bullish stances of the Chemical and Heavy industrialization especially development of IRON AND STEEL.

The positive changes will include but not limited to the fact that they will maximize potentials, encourage private sector operators to go into capital Intensive productivity such as :.Electricification will greatly assist the progress of industries dependent on electricity such as electrochemical and the refining industries . Power generation, Automotive industry, Blue economy, Sponsorship of Research and Development get more involved in oil and gas business as well as in Food security,.

DEPOSITORS

Merger and acquisition has been widely used for organizational growth however, it should be ensured that consolidation exercise has a life of its own and no depositor should lose fund after the banks have merged.

POST. CONSOLIDATION COST.

Needless to say that the post consolidation challenges are enormous and visible to discerning observer in the industry, this has further tempted many to conclude that post consolidation challenges are even more daunting than recapitalization itself.

Consolidation has resulted in very high financial cost for banks, including due diligence costs, high costs of redundancy of Its software / hardware where merging banks systems are incompatible. Others include

– Corporate governance credit risk, Operational risk, Skill gap, Regulation and compliance risk, lack of transparency in financial reporting, distress resolution, post consolidation integration, fit and proper test of all ensuring the enthronement of good corporate governace and capacity building.

CAUSES OF FAILURE IN CONSOLIDATION.

Inability to integrate personnel and systems as well as due to irreconcilable differences in corporate culture and management. Resulting in Board and Management squabbles. In addition, the emergence of mega banks is bound to task the skills and competences of Boards and Management teams in improving the shareholders values and balance same against other shareholders interests in a competitive environment. Disagreements over such issues as executive remuneration and perks, dividend policies and appointment of key officers may be some points.

Consolidation may not be literally over until all the Information and Communication Technology (.ICT) Infrastructure of the merged or acquired banks are fully integrated into a unified whole. Additionally, CEOs and Executive Directors need to be more ingenious and alert in choosing a more viable investment alternative capable of bringing superior returns. A well defined code of corporate governace practices should help organizations overcome post consolidation difficulties.

In furtherance to this, regional managers should be armed with necessary power and authority to make decisions in line with the goals of the bank. Hopefully, when these happen, there would be a greater efficiency in the way business is done generally with potential to boost the level of revenue. The much anticipated gains and benefits of consolidation will not automatically come unless banks are repositioed and re-strategized to exploit the new landscape in the industry.

At WufasAgronet, we are competent and reliable Food Technologists into Human Capital and Value Chain Development Consultancy in Food Processing technology.

Detailing Global competitiveness and International Best practices in Food Processing technology.

Contact: email wufasagronet@gmail.com

-

Food Security3 years ago

Food Security3 years agoREALITIES OF LARGE SCALE INTEGRATED AGROPRENUERAIL FARMING AND FOOD PROCESSING BUSINESS IN NIGERIA. (Update)

-

Environmental3 years ago

Environmental3 years agoOPINION: AN ACCESSMENT OF NIGERIA’S PERFORMANCE IN THE OPTICS OF THE UN 17 SUSTAINABLE DEVELOPMENT GOALS AGENDA 2030. ( Periodic quaterly review & update — ( September ’22)

-

Food Security4 years ago

Food Security4 years agoEXCITING FACTS ABOUT RANCHING

-

Food Security3 years ago

Food Security3 years agoTOP SEVEN AGRICULTURAL COMMODITIES WITH HUGE UNTAPPED POTENTIALs – update

-

Food Security4 years ago

Food Security4 years agoMITIGATING THE MENACE OF CLIMATE CHANGE THROUGH GREENBOND ISSUANCE.

-

Food Security4 years ago

Food Security4 years agoFISH PROCESSING TECHNOLOGY

-

Food Security3 years ago

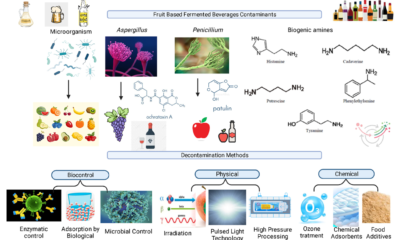

Food Security3 years agoMICROBIOLOGICAL AND CHEMICAL EVALUATION OF LOCALLY FERMENTED BEVERAGES — PITO & BURUKUTU

-

Food Security4 years ago

Food Security4 years agoTHE ROLE OF E -COMMERCE IN SYNERGISING AGRICULTURAL VALUE CHAIN DEVELOPMENT IN AFCTA IS SINE QUA-NON.