Food Security

FINANCIAL MANAGEMENT IN SMALL SCALE INDUSTRIES.

Www.wufasagronet.com

■ EMPOWERMENT TRAINING WORKSHOPS

ON MODERN AGROPRENURIAL processing SECTOR.

● Concept of Financial Management.

● Objectives of Financial Management.

● Sound bookkeeping , Budget, Cash Flow etc.

……@WufasAgronet, we don’t know more than Food.

✅Earned “FAO” Top Fan barge.

✅Member NAAJ , IFAJ & AFAN.

CONCEPT OF FINANCIAL MANAGEMENT.

Business finance can be broadly defined as the activities concerned with the planning, raising, controlling and administratering the funds used in business. This definition is concerned with financial management of profit – seeking business organisations engaged in all types of activities.

INTRODUCTION

• Finance plays a significant role in the operations of any purposefull organisations.

• Proper planning and control of business finance leads to efficient utilisation of resources.

• Financial decisions also alter the size and variablity of the earnings stream or profitability.

•The value of the firm is determined by financial policy decision , sich as risk and profitability.

• The assignment of financial management is to strike a harmony among hazards and productivity by contributing the most astounding long haul an incentive to the protection of the fitm.

• Financial management , subsequently plays out pivotal role in the survival and achievement of business undertakings.

• Financing is the basic management work which gives the methods for curing shortcomings in different zones.

• Financing thus is an integral part of managerial functions and responsibilities affecting an organisation’s performance.

• Financial management includes bookkeeping, projections, financial statements and financing which formd the foundation for reaching your goals through sound business decisions.

• Financial management is one of the main avenue to success as a business owner.

• Financial management is the way you know if you are making profit .it helps to decide what you can afford in terms of store or office location, inventory purchases, employees and equipment.

• You need sound financial information to set your prices and select your vendors.

• Financial mgt gives you the tools to plan for overall business growth gor diversification og your product line or reaching new markets.

• Financial management helps you decide which products , services and markets are profitable.

• Effective financial management gives you tools to chart your course into the future adjust your decision when needed and help you find your way through challenging times.

If your business growth requires financing ( loans ), Fin.mgt provides the information to know how much you can afford for your business.

• Financial management gives you the documentation needed for a loan application but also helps discuss your business circumstances with a lender in terms that improve your ability qualify for loan.

• The importance of Fin.mgt is thus universally recognised in business undertakings.

Industrial development is a legitimate objective to solve the economic and social problems present in any country. It assumes a critical job in the end of the financial backwardness of the rustic and immature areas of the nation in the achievement of confidence and in the decrease of territorial uneven characters.

• Effective fin.mgt is basic to the survival and accomplishment of each business endeavours.

• Tragically, numerous small scale proprietors have moderatly restricted introduction to fin.mgt and have been uninformed of how deliberately significant it is to their business execution.

• Wasteful financial mgt harms business productivity and constantly influences the development of Small sScale Enterprises

• Better monetary administration can lead the venture ahead in rivalry just as it will assist the business person with avoiding the circumstances of industrial disorder.

OBJECTIVES OF FINANCIAL MANAGEMENT.Financial management decides how assets are secured and utilised . They identify with a company’s financing anf speculation strategies. To settle on unavoidable and constant budgetary choices as method of reasoning , the firm should have a goal.

The properly defined and understood objectives are the key, to successfully moving from the firm’s present position to a future desired position.

Since business firms are profit making organisations, their objectives are frequently expressed in terms of money. Two essential targets ordinarily experienced are amplification of benefits and augmentation of riches

The last is an operationally legitimate standard to be received to boost the welfare of proprietors.

SOUND BOOKKEEPING IS THE BASIS FOR ALL FINANCIAL MANAGEMENT.

Bookkeeping is the organised process of tracking all income and expense transactions.

Bookkeeping is a critical component .of financial management , which leads to better business decisions regarding taxes, owner’s draw and retirement. Here are eleven basic bookkeeping steps:

—- Obtain business accounting software . Proper software selection is critical fot success (or manual at initial stage ).

—- Open a separate business bank account . Do not mix business and personal checking accounts.

—- Reconcile your bank account (bank reconciliation ), Each month , reconcile your account using business accounting software or cloud computing reconciliation process. (or manually).

—Track sales . Create an airtight system for tracking sales using tools such as a register tape, invoices and a sales book. Always use this sales tracking system. Fin.mgt for a Small Business Participant Guide.

— Deposit all sales using the duplicating deposit slips, deposit all sales in your business bank account.

Alternatively “remote deposit capture” (on line or transfer) may be available for depositing — this technology allows you to deposit into your account from your office by sending the bank an electronic image of the check . Total sales should equal total deposits. Don’t spend cash sales. Link all forms of sales documentation ( such as invoices, cash register tapes and sales books ) with a specific deposit.

—- Write business cheque for all business expenses. Don’t use a petty cash system until you are experienced at bookkeeping.

—- Obtain a separate business credit or debit card. If you plan to use a card for business expenses, consider obtaining a card in your company’s name . Doing so will help you keep track business expenses.

—- Pay business expenses first. Most businesses start out as a sole proprietorship . In sole proprietorships , you , the owner , do not get a salary , rather you take an owner’s drawing. A common question is how much drawing to take.?

Here is a rule of thumb; Sales pay for business expenses first . Personal expenses second (step 10 below).

—- Run a profit and loss ( P&L )statement.A bank account balance is not a good indication of how much profit the business has made or what amount is available for owner ‘s draw. A P&L statement can provide a better picture of the financial health of the organisation.

—- Pay yourself with owner’s drawing. Owners should pay themselves by writing a cheque or making an electronic transfer from business account to a personal account. If you are a sole proprietor , assign those drawing account called ” Drawings”.

BUDGET

Creating a budget is the first place to start with your financial management practice. A budget is a list of all your ( monthly or yearly ) expenses, organised by categories . A budget is a tool that helps you:

Track all your business expenses.

Plan for the future.

Economize when you need to.

Plan for expansion.

Make a profit.

Once you create a budget, use it to compare what you’ve budgeted with your actual expenditures.

CASH FLOW

Cash flow can be defined in two ways:

》 Balance of cash received less the amount of cash paid out over a period of time.

》 Moving cash in or out of a business.

Cash Flow Projection

A cash flow projection id a financial statements that tries to show how cash expected to floe in and out of business over a future period of tome.

A cash flow projection i used to see if projected cash receipts (in flows) will be sufficient to cover projected cash disbursements (out flows )

A business can be profitable and still rin out of cash.

A s an investment banker might say ” Cash flow provide the visibility needed to avoid liquidity problems .” In order words , a cash flow projection is a tool.to help you manage your cash so you can pay your bills on a timely basis and keep the door of your business open.

A cash flow projection is a great tool fot setting sales goals and planning for expenses to support those sales.

A related use of a projection is to determine your breakeven point during a start-up or expansion phase . If you need to plan for a large expenditure, such as an equipment purchase or move to a new location , a cash flow projection is a perfect tool.

Similarly, if you have a seasonal business with large inventory purchases, a projection can help you have the cash on hand to make large inventory investment when you need it.

A P & L statement can mask cash shortages if you use accrual accounting. A cash flow projection helps you see the cash status of your business now and plan into the future. A cash flow projection is a good way to prepare and plan for your financing needs and is often a required part of a business loans application.

CASH FLOW PROJECTION.

》 The first set of rows, titled Sources of Cash.

Document all sources of incoming cash, including cash from customers sales , interest earned, loan funds and current checking and savings account balances.

Sources of Cash

● Cash sales

● Collections on A/R

● Interest income

● Loan Received

● Equity Contributions

Total Cash Available

■ The second section , Operating Uses of Cash.

Contains all those expenditures associated with the day – to – day buying and selling process. Most of these expenses show up on P & L statement.

● Contract Labour

● Wages

● Payroll Taxes

● Rent

●Phone

●Office Supplies

● Utilities

● Insurance

● Marketing

● Professional Fees.

The third section, Non -Operating

Uses of Cash, show expenses that normally show up on your Balance Sheet : equipment purchases , the principle portion of loan payments, inventory, , Taxes and Ower’s draw. Subtract your uses of Cash from your total Cash Available and you have Ending Cash for the month. Which becomes Opening Cash for the next month.

●Debt Service

● Capital Purchases

● Self -Employment Taxes.

● Owner’s Draw

● Inventory Purchases.

PROFIT AND LOSS STATEMENT

Functions of Financial Management.

The financial management function is not a standard operation. The functions vary from firm to firm depending upon the size of the company, nature of industry and tradition. In small units the proprietor for the most part handles all issues including the obtainment and use of assets while in the medium estimated organisation monetary official might be worried about the budgetary administration. In a major venture essential significance is given to the money related directors to take choice on different capacities, for example, profit strategy , renegotiating of development , presentation of another item , dealing with the association’s working capital .Hence, the functions of financial management vary from firm to firm depending upon circumstances.

Generally, the investigation of business finance is fixated on either the management of the company’s present resources; money, debt claims and inventories or the company’s procurement of assets. Be that as it may, in the cutting edge approach, account capacity involves a key position in the company’s general management and assumes a note worthy job in arranging and estimatimg the association’s requirement for assets in raising the vital assets and afterwards putting the assets procured to viable use . Hence, measuring, acquiring and using of funds are the three basic functions og finance.

FIVE KEY POINTS TO REMEMBER

■ Financing is getting the money you need to start , operate or grow your business . Before borrowing money for your business , develop a business plan to help determine whether your business can afford a loan. If you need to borrow money , take time to compare – shop for the best loan options.

■ Start financial management with a budget.

■ Sound bookkeeping is the basis for all financial management

■ Cash flow projection will help you to see cash shortages even when accrual accounting may mask these shortages.

■ A Profit & Loss (P&L) statement is the best tool for knowing if your business is profitable. Financial Management for a Small Business Participant Guide..

STATEMENT OF THE PROBLEM.

— Lack of demand and shortage of working capital have been the main reason for acute and incipient sickness in both the registered and unregistered units in Small Scale Enterprises sector.

—- Every kind of problem , whether of raw material, power, transport, labour or marketing, faced by an entrepreneur in it’s ultimate analysis turns out to be a problem of finance.

— Finance is the backbone of every business enterprise . It has to be managed effectively so that there arise on waste of physical and financial resources . It has been a critical success factor for the organisation.

—- The Small Scale Enterprises have a restricted source of finance. Input and technology . So they have to be more careful in utilising them. All the entrepreneurs have the main objective of maximising growth. The focus has been on the increase of profitability, turnover and long term growth.

Sometimes, this has been achieved at the expense of short term profitability on the return on the capital. This situation may not be necessarily due to lack of capital or finance, but due to poor management of funds.

—– Lack of financial management has been limiting the growth of any enterprise; at the same time , utilisation of funds got affected the use of all the other resources. Any type of entrepreneurial activitiy concerned with production , marketing, personnel and the ultimate revolves around the availability of financial resources.

—- Financialh Managementhas been the key factor which determines a business will be successful in.the long run. In the case of Small Scale Enterprises, gaining profit got affected by a number of factors, like: innovative productivity, credit availability , market for their products, Skill labours and prudent financial management.

Out of the above factors, management of finance has been very important as this affects the day to do the running of the firm. Therefore , along with profitability, liquidity is also very important for any enterprise.

●The twin factors of profitability and liquidity can be achieved if a firm has got good financial management practices.

MICRO SMALL AND MEDIUM ENTERPRISES IN GLOBAL PERSPECTIVE.

Countries over the globe don’t utilize a similar definition for grouping their Small and Medium Enterprises (SME) and area nor complete an all – inclusive definition give off an impression of being vital. The definitions being used rely upon the reasons for which they have been implied , and has required to serve the strategies that oversee the SME part in this way characterized. Real parameters for the most part had been connected by most nations , independently or in mix. , in characterizing SME area include.

》Capital investment in plant machinery:

》 Number of workers employed

》 Volume of production or turnover of business.

Micro, Small and Medium Enterprises have also been referred to as SMEs and Small and Medium – sized Businesses (SMB) in some countries.

The SME occurs commonly in the European Union and in international organisations such as the World Bank , the United Nations and World Trade Organisation. The term Small and Medium sized Businesses or SMBs had been predominantly used in the USA .

In the European Union /USA SMBs are companies whose headcount or turnover falls below certain limits. The business has classified as per the number of employees employed in it.

At WUFASAGRONet, we are Competent and Reliable Food technologists into Human Capital Development in AGROPRENURIAL -Processing.

The On-going depression in Nigeria has eroded the opportunities for decentjobs especially for the teeming youthful population which has initiated coherence in the implementation of youth employment policies and programmes. Our consultancy join in offering Financial & Business support services to AGROPRENURIAL processing that promotes Sustainability in food and environment.

This insight into Finance information was a collaborative efforts of WUFASAGRONet and Rev. N.A. LAWAL FCA.

Email : wufasagronet @ gmail .com

Food Security

CHARACTERISTICS OF GOOD DETERGENT

CHARACTERISTICS OF GOOD DETERGENT

www.wufasagronet.com

….. @WufasAgronet, we are Food Security (processing) Advocates.

✅Earned FAO, WFP, WORLD BANK, IFAD, IDA, IMF, UNSDGs, USAID, ROCKEFELLER FOUNDATIONS, BBC NEWS, JAGABAN ARMY, PUNCH NEWSPAPERS, GUARDIAN Newspapers, Today Reporters, Ripples News etc TopFan Barges.

✅Member NAAJ, PAAJ, IFAJ AND AFAN.

✅Consultancy Services in Human Capital and Value Chain Development in Food Processing technology.

DETERGENTS used for washing in industries should have the following characteristics.

-Ability to loosen organic matters eg. Soil etc. (organic dissolving power)

-Good rinsing power.

-Adequate wetting power to allow detergent to penetrate the deposit acting quickly and efficiently.

-Good sequestering power – removal of mineral deposits eg. Calcium, magnesium.

-Emulsifying power – fragmenting oil into tiny particles.

-Adequate germicidal power to sterilized dirty detergent solutions.

-Ability to dissolve alkali solutions precipitate of calcium and magnesium salt.

-It should not be corrosive.

-It should posses good buffering and saponifying powers.

The above characters may not be contained in a single detergent but if blended with others rich in some of the characters, a good result may be achieved.

MAJOR SOURCES OF DETERGENTS.

{Alkalis} – Caustic soda is the basic ingredient of detergent however,

there could be addition of other additives to give a property to the detergent. Other basic ingredients are Soda ash, Sodium silicate and others as seen above.

SEQUESTERING AGENT.

This is the action of polyphosphate in precipitation of calcium and magnesium salts in water creating additional wetting agent and polyphosphate to assist sequestration this would constitute most effective and economical clean-in-place detergent for brewing cleanings.

WETTING AGENT.

Known generally as synthetic detergent, Wetting agents are classified into 3 major types :An-ionic and Cat-ionic wetting agents.

The An-ionc type is commonly used for detergent formulation eg. Sulphated alcohols alkyl or aryl sulphonates. Non-ionic are mostly the polyethylonic oxide. On blending of both an ionic and catonic the result may be excessive foaming. It also processes good wetting, dispersing and rinsing power.

STERILISING AGENT.

Alkalis porcess sterilizing power, which increases with pH and temperature.

At WufasAgronet, we are competent and reliable Food Technologists into Human Capital and Value Chain Development Consultancy in Food Processing. Contact us email :wufasagronet@gmail.comPls go through the earlier sent documents.

Food Security

SEASONINGS. FLAVORS. FOOD INGREDIENTS.

✔Contact us @WufasAgronet for wide range of integrated flavors and seasonings, we are Manufacturers’ Representative.

…. @WufasAgronet we are Food Security (Processing) Advocates.

✅Earned FAO, WFP, WORLD BANK Group, UNSDGS, ROCKEFELLER FOUNDATIONS, BBC NEWS, JAGABAN ARMY, PUNCH NEWSPAPERS, GUARDIAN Newspapers, Today Reporters, Ripples News, etc TopFan Barges.

✅Member NAAJ, PAAJ, IFAJ & AFAN.

✅CONSULTANCY SERVICES IN HUMAN CAPITAL AND VALUE CHAIN DEVELOPMENT IN FOOD PROCESSING.

✔FLAVORS

BAKERY & PASTRY FLAVORS

*Vanilla flavor

*Condensed milk flavor

*Butter scotch flavor

*Enzyme chocolate flavor

*Enzyme butter flour

*Milk flavor

*Coconut flavor

✔ CONFECTIONERY & CANDY FLAVORS

*Strawberry flavor

*Chocolate flavor

*Orange flavor

*Butter vanilla flavor

*Banana flavor

*Mango flavor

*Lemon flavor

*Milk flavor

*Vanilla flavor

*Apple flavor

*Mixed berry flavor

*Coconut flavor

*Caramel flavor

*Honeydew flavor

*Condensed milk flavor

*Peanut flavor

*Cheese flavor

✔BEVERAGE FLAVORS

*Apple flavor

*Coconut flavor

*Caramel flavor

*Mango flavor

*Lemon flavor

*Banana flavor

*Pineapple Flavor

*Orange flavor *Strawberry flavor

*Natural Ginger flavor

*Malta flavor

*Grape flavor

*Raspberry flavor

✔ENCAPSULATED FLAVORS

*Strawberry flavor

*Raspberry flavor

*Mixed Berry flavor

*Orange flavor

*Apple flavor

*Banana flavor

✔BEVERAGES (CONCENTRATES, COMPOUNDS, BASES AND EMULSIONS) :

*Pineapple

*Lemon

*Ginger

*Cola

*Black currant

*Orange

*Strawberry

*Chapman

*Apple

*Banana

*Mixed fruit

*Cocopina

✔SAVOURY FLAVORS

*Beef flavor

*Chicken flavor

*Tomato flavor

*Cheese flavor

*Seafood flavor

*BBQ flavor

*Roasted flavor

*Smoked fish flavor

*Suya flavor

*Peanut flavor

*Roasted Chicken flavor

*Sardine flavor

*Smoke flavor

✔MILK POWDER :

*Fat filled milk powder

*Skimmed milk powder

*Full cream powder

*Flavored milk powder

*Butter milk powder

✔ICE-CREAM, YOGHURT & DAIRY FLAVORS :

*Yogurt flavor

*Vanilla flavor

*Strawberry flavor

*Banana flavor

*Mixed Berry flavor

*Chocolate flavor

*Cherry flavor

*Mango flavor

✔SEASONINGS:

FOOD SEASONINGS

*Beef seasoning

*Chicken seasoning

*Tomato seasoning

*Cheese seasoning

*BBQ Seasoning

*Seafood seasoning

*Noddles seasoning

*Pasta seasoning

*Jollof seasoning

✔SPICES :

*Cinnamon powder

*Onion powder

*Ginger powder

*Garlic powder

*Paprika powder

*Nutmeg powder

✔FOOD INGREDIENTS :

*Fat Replacer (Handisol – 25)

*Sweetener

✅OTHERS :

*Real meat reaction pastes

*Vegemeat for sausage roll

*Spice flavor oil

*Liquid and oil soluble flavor

*Soup and gravy mixes

*Ice cream premix

*BBQ sauce

*Tomato /Pizza sauce etc.

At WufasAgronet , we are competent and reliable Food Technologists into Human Capital and Value Chain Development Consultancy in Food Processing technology training the teeming youthful population including teirary institutions graduates in Global Competitiveness and International Best practices in Food Processing technology.

Contact email wufasagronet@gmail.com

Food Security

SECURITY PATHWAYS IN RELATION TO SUSTAINABLE FOOD SECURITY OF A NATION.

Good governance is predicated on ensuring the actualisation of the various security architecture of a Nation. The political barometer is also monitored through the efficiency of the security pathways which are :

INTERNAL SECURITY, INFORMATION/COMMUNICATION. , FOOD SECURITY, HEALTH ,EDUCATION, ELECTRICITY, TRANSPORTATION AND INDUSTRIAL GROWTH.

.

All the above are the essential security systems that can produce and provide QUALITY POPULATION through good and quality SUPERVISION

✅NATIONAL Security of life and properties is the (numero uno) number one responsibility of the Head of government be it President, Head of state and others. The mandate to secure life and property is paramount , they control and command the apparatus of security such as adequate Policing, effective Armed forces- Army for protection against external or internal aggression. Customs / Immigration for vigilant boarders patrol to prevent smuggling and immigration control amongst many others . Equipping them with weapons, Aircrafts, Vehicles, Boats etc.

For effective surveillance. In tackling the menace of bandits and kidnappers who have taken over the forest prohibiting farming activities . Armed Forest Guards / Rangers should be introduced.

INFORMATION/COMMUNICATION.

The entire world is in information age.

The constitution clearly stipulate that every person shall be entitled to freedom of expression, freedom to hold opinions and to receive as well as to impact ideas and information.

However, it is the opinion of this writer that freedom be guided with secured intent to prevent abuse that may result in conflicts and war through hateful and unguided utterances.

The most acceptable form of communication is such that promote humane, responsible and patriotic reportage upholding the concept of discipline and promoting values nationally and internationally.

A lot of opportunity mostly untapped abound for investment in Information and communication like Print, Electronic and ICT media.

For industrial growth, information through advertisement, publication and social media is vital for public awareness.

FOOD SECURITY

Whether one eat to live or live to eat is a matter of semantics the bottom – line is Food is the main sustainace of bodies and souls. The importance of food cannot be over emphasised . knowing this fact of life has made the developed world to appropriately plan for provision of quality food for their citizens. Provision of food is prioritize in their national agenda. It is on this note that the United Nation’s clarion call to others in the world to emulate the culture of Sustainable Food Security ensuring the Tripple A(s). of AVAILABILITY, ACCEPTABLITY and AFFORDABILITY. ( UN 2030 food security agenda) of good quality food for the underdeveloped countries who are import dependent on basic food items such as Rice, Sugar, Dairy , Beverages etc .

Presently, Nigeria is revolutionising agrioprenuerial activities, it’s hoped that the present policies on agriculture will not be Summersaulted. The Maputo declaration on allocation of minimum 10% of the country’s annual budget must go to agriculture. Food must be made a constitutional right for all. The authority must take time to support Micro and Small scale Agroprenuerails activities to adapt to climate change. Agroprenuerail activities is the surest way to lift hundreds of millions out of hunger, poverty, conflict and deaspiration.

HEALTH CARE

Health is wealth – Primary Health care delivery must be taken to the grassroot levels, while Rural Health care moblisation be made available and effective all must be well equipped with vaccines, drugs, consumables and other biologicals.

— Ensure maintenance of standard by private sector through effective monitoring.

— Tapping into Herbs Processing , local medical herbs be Researched into by National Institute of Pharmaceutical RnD. In Collaboration with Fed Mins. of Science and Technology.

— Integration of alternative medicine into health care.

— Health insurance scheme must be intensified on .

— Stemming of illegal importation of smuggled fake drugs and illegal drug manufacturing in the country.

EDUCATION

A Society, Community and Nation is as good as the percentage of her literary population. The various levels of education are Primary , Secondary and teriary education 6-3-3-4 .Education must attract appropriate budget at all time. Education is being administered by Public and Private participation at all levels. The special education must receive attention by provision of special equipment such as braille machine, audiometer etc.

ELECTRICITY

To the chagrin of the unsuspecting consumers and Contrary to claim of the generation companies that generation capacity has improved to 7000 MW , the actual has been fluctuating between 2500 -3500 MW.(April 2019)

The idea of mono grid must be jettison while the legislation be relaxed to accommodate Private participations in generation. While effort must be intensified on the Green Bond of #10.97bn raise in December 2018. for financing of SOLAR energy.

Industrial development is unachievable without steady supply of electricity. A green belt of

Industrial Parks on Green energy is recommended in all the States of federation.this will sustain industrial activities that will promote growth.

TRANSPORTATION

This sector is an indispensable catalyst for stimulating economic, social, political and strategic/defence development of a Nation. All the National Development plans must accord the transport sector very high priority. In the formulation of National Transport policy, there must be defined objectives such as economic efficiency and coordinated development plan.

All forms of transportation system are embraced in Nigeria. Motor ,Railway transportation, inland waterways, aviation terminal and handling facilities seaports, airports and riverports including other ancillary facilities.

The administration of Transportation is vested in both Fed. Ministry of Works and Housing (Fed. Highways – Interstate roads Construction and maintenance) and State Ministry of Works/Transport (interstate roads while LG is responsible for Urban and Rural roads Construction and maintenance.

Aviation Ministry for Civil Aviation, Airports Development Management and Metrological services.

Internationally, the railway system is more affordable and relatively saver the frequency in Nigeria must be upgraded not scanty show up as is now the case.

INDUSTRIAL GROWTH

The economic growth rate ( 2019) is 2.1% ,this development is not unconnected with the dismal performances of the various indices above. eg the manufacturing growth rate is presently less than 7% although the Fedreral government set a 10.6% goal in 2017.which was to be driven by SME. Productivity is the only stimulant for Industrial growth. Farming output is barely about 22% mostly subsistence. .about 55% of work force is absorbed by agriculture. The major farming communities in North East, Middle belt downwards to the southern section are being sacked either Boko Haram terrorist or Pasteuralist /Farmers conflicts and banditry.

The various activities as enumerated in this writeup are all depended on Food security system. FOOD SECURITY MUST BE IN THE FRONT BURNER TO ACHIEVE SUCCESS. IN OTHER SEGMENTS.

CONCLUSION

— FOOD Security issues must be in the front burner of government’s agenda. Since it encompasses all other activities.

— The effectiveness of other parasatal must be ensured through adequate supervision.

— TO PREVENT IMMINENT DANGER OF FAMINE. Forest Guards (armed) must be appropriately deployed to secure the large expanse of the forest for Farming activities.

— Indigenous Reserch and Development on local Technology be improved on.

— Electricity generation from Green Energy source should be encouraged in the Industrial parks.

— Food Security system must be made a CONSTITUTIONAL RIGHT for all the citizenry.

At WUFAS AGR0Net, we are Competent and Reliable Food Processing Technologists ,into Human Capital Development Consultancy. Centering on ETHICS of Food Processing Technology. Training on industrial food processing (General Manufacturing Principles ) to the teeming youthful population, startups and other Food handlers. We are seeking Collaboration and Strategic partnership with corporate bodies, NGOs and others

Interested in Food Security.

Contact: 08157784430, 08034064270.

Emails wufasagronet @gmail.com

-

Food Security4 years ago

Food Security4 years agoREALITIES OF LARGE SCALE INTEGRATED AGROPRENUERAIL FARMING AND FOOD PROCESSING BUSINESS IN NIGERIA. (Update)

-

Environmental3 years ago

Environmental3 years agoOPINION: AN ACCESSMENT OF NIGERIA’S PERFORMANCE IN THE OPTICS OF THE UN 17 SUSTAINABLE DEVELOPMENT GOALS AGENDA 2030. ( Periodic quaterly review & update — ( September ’22)

-

Food Security4 years ago

Food Security4 years agoEXCITING FACTS ABOUT RANCHING

-

Food Security3 years ago

Food Security3 years agoTOP SEVEN AGRICULTURAL COMMODITIES WITH HUGE UNTAPPED POTENTIALs – update

-

Food Security4 years ago

Food Security4 years agoMITIGATING THE MENACE OF CLIMATE CHANGE THROUGH GREENBOND ISSUANCE.

-

Food Security3 years ago

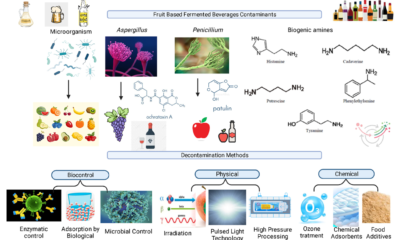

Food Security3 years agoMICROBIOLOGICAL AND CHEMICAL EVALUATION OF LOCALLY FERMENTED BEVERAGES — PITO & BURUKUTU

-

Food Security4 years ago

Food Security4 years agoFISH PROCESSING TECHNOLOGY

-

Food Security4 years ago

Food Security4 years agoTHE ROLE OF E -COMMERCE IN SYNERGISING AGRICULTURAL VALUE CHAIN DEVELOPMENT IN AFCTA IS SINE QUA-NON.